IURC Case #45870 was approved by the Indiana Utility Regulatory Commission on February 21, 2024.

The Indiana-American water company rate increase will be implemented in a 3 step process with the last

step being implemented in May 2025.

Step 1 - Effective date is February 21,2024.

Step 2 - Anticipated effective date is sometime during May 2024.

Step 3 - Anticipated effective date is during the month of May 2025.

The information below is for a 5/8" water meter - this is the standard size for a residential property.

Base charge - $20 a month

Usage charges - The first 1,500 gallons or 15 bill units (1 unit = 100 gallons) is now included in the base

charge (no extra cost)

Step 1 Additional bill units (16 thru 135) is now $1.06262 per 100 gallons

Step 2 Additional bill units (16 thru 135) will be $1.18982 per 100 gallons when implemented in May 2024.

Step 3 Additional bill units (16 thru 135) will be $1.38055 per 100 gallons when implemented in May 2025.

The Public Fire Protection Surcharge (5/8" meter) declined slightly and is now $4.77 per month.

The Distribution System Improvement Charge (DSIC) is now no charge (was previously $7.98 a month)

The System Enhancement Improvements (SEI) is now no charge (was previously $1.07 a month)

The above information was collected and disseminated from public documents located on the IURC

website and from newspaper articles available to the general public via the Internet.

There are two attachments at the bottom of the e-mail that provide the majority of information provided

above.

On a personal note, a review of my water bill shows that the usage calculation is WRONG.

I have called and spoken with customer service and they were NOT able to provide a logical explanation

for the usage being incorrect so it has been escalated to the billing department for review.

The amount in question is less than $5.00 but I told customer service that if this error is multiplied outward

then it becomes a much larger sum of money being incorrectly collected. They agreed with me as to

this point. They were required to tell me that it could take up to 10 days to resolve but it typically

takes less time.

Sincerely,

Darin Sherman

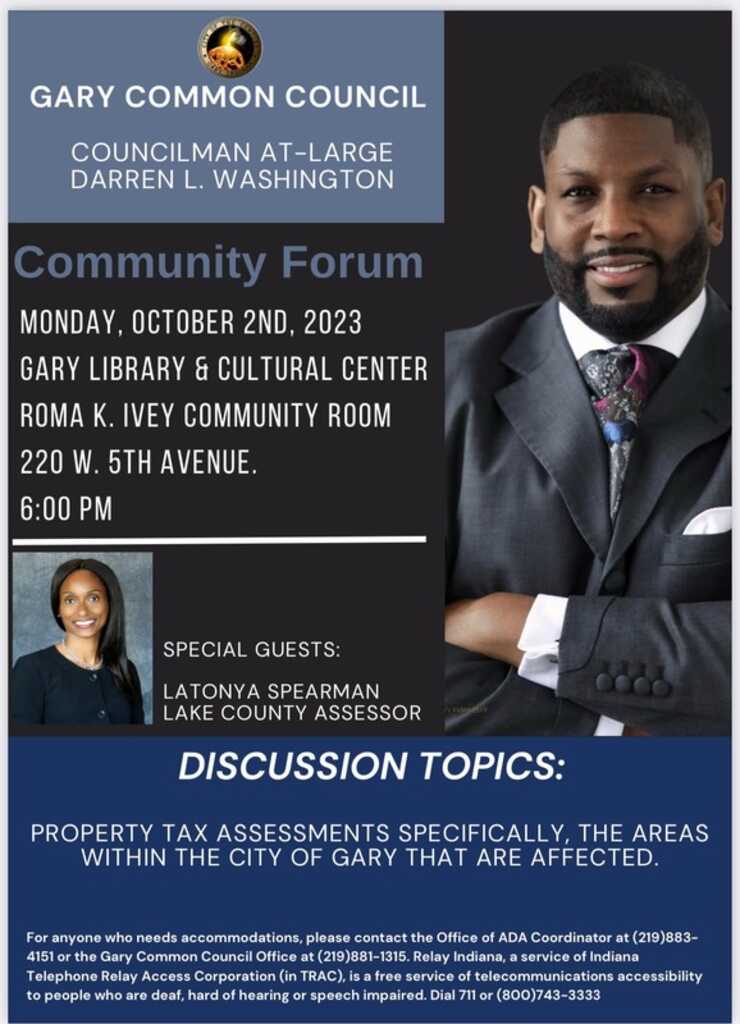

I am writing to you on behalf of the Miller Citizens Corporation (MCC), a 501c8, 52-year-old neighborhood organization whose newsletter has more than 900 subscribers, the Miller Business Association (MBA), a 501c6 that began in 1946, and Cap All Property Taxes (CAPT), a Political Action Committee.

The MCC sprang into action on April 1, 2004 when we learned our property tax rate would rise to 9% of assessed valuation, mainly because the Indiana State legislation reassessed US Steel's valuation from $248 million to $118 million. We were able to stop the proposal via court action and get an executive order of a temporary 2% cap. Our work in the Indiana legislature resulted in the successful 1%, 2% and 3% property tax caps. CAPT was organized when it became necessary to fight increasing tax burdens such as the wheel tax, the Distressed Unit Appeals Board adding an additional tax for 3 years onto our property tax bills, and the Gary Community School Corporation referendum that will tax us for the next 4 years. The effect of the land order on the referendum, which is over and above the tax caps, will result in a one-two punch to our community, significantly increasing our tax obligations.

Indiana property taxation is supposed to be fair, comparable to like-in-kind neighborhoods and not suddenly excessive and overbearing to the taxpayer. Two comparable neighborhoods that share the amenities of Lake Michigan and Indiana Dunes National Park are Ogden Dunes and Dune Acres.

Let's compare base front foot rates with a market factor of 1.00 for these three neighborhoods for 2023/payable 2024.

Exhibit 1 NC 2500 Land Sales

Exhibit 2 NC 2513 Land Sales

Exhibit 3 YOY Tax Increase

In 2003, legislation at the state level brought on a property tax crisis for Miller residents. At the same time, Indiana changed the basis of assessing property and reassigned the responsibility for assessing our major industry - US Steel. The result was a huge shift of the property tax burden from industry to individuals, which was especially hurtful in Miller. The MCC saw this as a survival issue for our community. We created the MCC Defense Fund to fight for reasonable taxation. We challenged the constitutionality of the new property tax legislation and won vindication from the Supreme Court, but no redress for injuries. We talked directly with Governor Kernan, and convinced him to institute, through administrative action, the first property tax cap. We have continued to fight vigorously for reduced government spending and a reasonable distribution of the tax burden, and we eventually found allies in the state government to continue and expand the property tax caps.

In the following years the 1% Homeowner, 2% Residential Rental and Farm land and 3% Commercial Indiana tax caps are now in the Indiana Constitution.

Cap All Property Taxes (CAPT) is the MCC's political action committee to keep units of government from overspending and engaging in excessive mismanagement. In recent years there have been three attempts by the Gary Community Schools Corporation to go around the tax caps. We stopped two but lost one to the tune of $9,000,000 the Gary property owners are now paying.

No referendum money needed to fix up buildings. Thanks to the Indiana Legislature, Gary Schools have $470,000 per month for 4 ½ years ($25,000,000+/-). Source: IN Senate Bill 408 as reported in The Times June 26, 2020

No referendum money needed for a slush fund with $4,000,000 from U.S. Steel's one-time payment to schools in lieu of property taxes. Source: The Times, December 19, 2019

No referendum money needed for coronavirus-related expenditures when receiving $4,000,000 through the CARES Act. Source: Indiana Finance Authority FAQs, June 12, 2020

No referendum money needed when Gary schools already get State of Indiana funding of $7,880 per student, local funding of $3,312 per student and Title I funding of $1718 per student, for a total of $12,910 per student. That’s $12,910 X 4,400 students or $56,804,000 per year to support students and even raises for teachers. Source: State of Indiana Department of Education Title I Forecast for the 2020-2021 School Year, IN DOE Form 9

CAPT will CONTINUE to be vigilant to fight any attempt to go around the Indiana Tax Caps.

2020 GCSC Referendum Tax Impact PDF

Donate to CAPT to ensure that your taxes are not increased unnecessarily.

CLICK TO DOWNLOAD PDF and mail in with donation to

1130 N. Vigo St., Gary, IN 46403

OR

PAY ONLINE (below)

* In making this contribution, I certify that I understand and I am compliance with the following: Campaign finance law prohibits a contribution made by one person in the name of another, or by a foreign principal or non-U.S. citizen who is not lawfully admitted for permanent residence in the United States.

Email us at capallpropertytaxes@gmail.com.

Paid for by Cap All Property Taxes, 1130 N. Vigo St., Gary, IN 46403

Prom 2025

Marquette Park Pavilion

Saturday, February 8, 2025 @ 7 PM

Clean-up

Starting at Miller Town Hall,

Grand Blvd & Miller Ave.

7:00 - 11:00 am

Saturday, May 4, 2024

Monthly Meetings

@ 7:00 pm

Marquette Methodist

Church on Grand Blvd.

the second Monday of every month

Monthly Meetings

@ 7:00 pm

Marquette Methodist

Church on Grand Blvd.

the second Monday of every month